Virtual Account

INFO

Virtual Accounts are available in Indonesia, Vietnam, Philippines, and Thailand. For Thailand, please contact your Account Manager or Customer Support to request activation. Virtual Accounts will be coming soon to Malaysia.

What is a Virtual Account?

Virtual Account allows you to receive payments via any local bank account. The way it works is similar to a normal bank transfer—your customers can simply transfer payments to your unique Virtual Account number, and you’ll get automatic notifications whenever a payment is made.

Type of Payment Flows

There are 2 available payment flows that you can choose from:

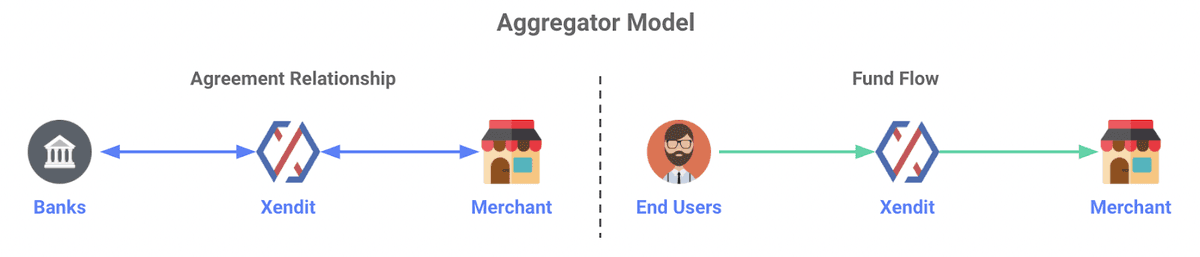

1. Aggregator Model (recommended)

You’ll use the Virtual Account code that belongs to Xendit, and we’ll collect payments on your behalf. Once your customer has made a payment, we’ll immediately transfer the funds to your Xendit balance. You can withdraw these funds any time.

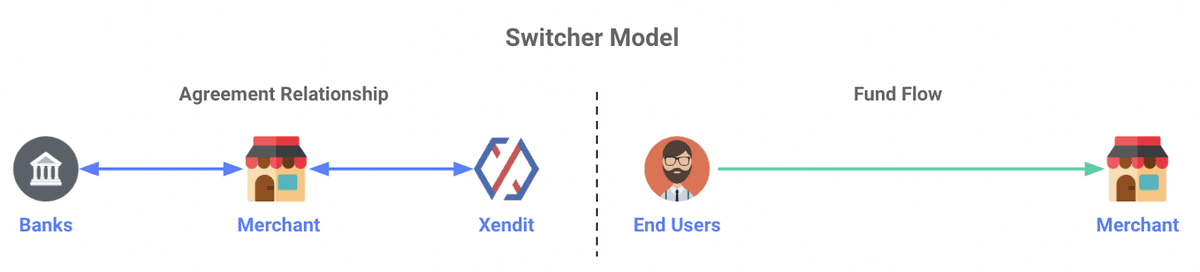

2. Switcher Model

You’ll create and manage your own Virtual Account, and payments will go straight into your bank account. Funds typically take up to 1 working day to settle into your bank account. If you opt for this model, you’ll need to open an account and complete an additional activation process.

Why do we recommend the Aggregator Model?

- Streamlined payment tracking: All of your payments will be automatically detected and recorded. This feature saves you valuable time by eliminating the need for manual payment checks.

- Access to a wide range of banks: You can receive payments from over 100 banks without the hassle of opening separate accounts at each bank. Xendit simplifies the process by providing seamless integration with our platform.

- Instant payments, including large amounts: Virtual Account is one of the fastest ways to receive payments, especially when you need to accept large amounts in one go.

Available Virtual Account Payment Channels

You can accept payments via Virtual Account with these banks:

| Bank / Network Name | Supported Commercial Model | Supported Country | Xendit Merchant Code (Aggregator) |

|---|---|---|---|

| Bank Central Asia (BCA) | Aggregator and Switcher | Indonesia | 7007 / 38165 / 38166 |

| Bank CIMB Niaga | Aggregator and Switcher | Indonesia | 93490 |

| Bank DBS Indonesia | Aggregator and Switcher | Indonesia | 9488 |

| Bank Jabar Banten (BJB) | Aggregator | Indonesia | 12345 |

| Bank Mandiri | Aggregator and Switcher | Indonesia | 88608 / 88908 |

| Bank Negara Indonesia (BNI) | Aggregator and Switcher | Indonesia | 8808 / 8930 / 7151 / 7152 |

| Bank Neo Commerce (BNC) | Aggregator and Switcher | Indonesia | 90100011 |

| Bank Permata | Aggregator and Switcher | Indonesia | 8214 / 7293 |

| Bank Rakyat Indonesia (BRI) | Aggregator and Switcher | Indonesia | 26215 / 92001 / 13281 / 13282 / 13404 / 13405 |

| Bank Sahabat Sampoerna (BSS) | Aggregator and Switcher | Indonesia | 40102 |

| Bank Syariah Indonesia (BSI) | Aggregator | Indonesia | 9347 / 9655 |

| MSB Bank | Aggregator | Vietnam | 9686 |

| PV Bank | Aggregator | Vietnam | AP88 |

| Vietcapital | Aggregator | Vietnam | 9990 |

| Woori | Aggregator | Vietnam | 9020 |

| VPB | Aggregator | Vietnam | 0024 |

| BIDV | Aggregator | Vietnam | 9630 |

| InstaPay / PESONet | Aggregator | Philippines | Custom |

| Standard Chartered Bank | Aggregator | Thailand | 6081 |

| UOB | Aggregator | Malaysia | 13556 |

| AmBank | Aggregator | Malaysia | 8884 |

Looking for other payment channels? Check out Payment Channels Overview.

Last Updated on 2024-08-19